Getting a Va Refi Pull Credit How Many Days to Close Before Pulling Credit Again

When does "cleared to close" not mean "cleared to shut"? When Fannie Mae'southward involved, that's when.

Fannie Mae's "Loan Quality Initiative"

Fannie Mae doesn't make loans. Rather, it buys loans from banks and securitizes them into mortgage-backed securities. Equally such, Fannie Mae wants to brand sure that every loan it buys to see its bones underwriting standards. That way, information technology can stand up backside the quality of its securities.

And, when nosotros talk well-nigh loan approvals, this is actually what's happening; your loan is existence underwritten based on Fannie Mae's guidelines. Loans canonical for closing are — presumably — in line with Fannie Mae'due south minimum standards.

We say "presumably" because when foreclosures began to increase last decade, Fannie Mae started an audit of its loans and establish large numbers of mortgage that had failed to meet its standards. Some loans, it found, were grossly underwritten, comprising its securities and its bottom-line.

To limit "bad loans", Fannie Mae created its Loan Quality Initiative.

The Loan Quality Initiative is wide in scope, comprising ix pages. For banks, it creates "extra steps" in underwriting. Information technology's validation of things like social security numbers and borrower occupancy. They're small tasks, but time-consuming, and there's a lot of them.

Every bit a mortgage bidder, you lot don't have to worry nigh what the depository financial institution is doing. Yous take one chore only — don't mess up your credit.

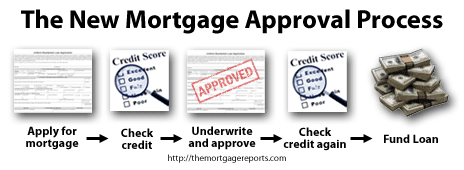

Just Before Funding, Your Credit Volition Be Repulled

The Loan Quality Initiative requires lenders to re-verify credit credit profiles simply prior to closing and to look for changes. In other words, although your credit was pulled at the start of underwriting, Fannie Mae wants your bank to pull it again — just in case something changed.

This ensures that loans are priced properly, and are funded on the borrower'southward adventure at closing as opposed to at awarding; because a lot can modify while a loan is in-process. Especially when the loan is for a purchase closing in 60 days or more.

Banks will repull your credit prior to closing. Some of the things they're looking for include :

- Did you apply for new credit cards while your loan was in-process?

- Did yous sew together existing cards while your loan was in-procedure?

- Did y'all finance an automobile while your loan was in-procedure?

- Did you brand some other major purchase while your loan was in-procedure?

- Did you add non-disclosed debts while your loan was in-process?

Each of the to a higher place is a red flag to underwriting. If your "final" credit study doesn't match your original credit written report, your mortgage may be subject to a consummate re-underwrite and, in a worst case scenario, a loan awarding denial.

The three Credit Hotspots For Loans In-Process

The Loan Quality Initiative is pretty straight-frontward and common sense-like. As a mortgage applicant, information technology'due south like shooting fish in a barrel to avoid its claws. There are 3 things for which an underwriter looks in your credit file.

Here are those iii items how the bank will react.

What the depository financial institution will do: Recalculate debt-to-income ratios using your "new" minimum payment due figures. If the DTI exceeds Fannie Mae's maximum threshold, the loan will be denied.

What y'all should exercise about it: Don't sew credit cards prior to closing — even for layaway items. Consider paying more than than the minimum due, merely in example.

What the bank will do: Utilise your new credit score to assess loan-level pricing adjustments or outright denials for when scores fall beneath Fannie Mae'south minimum credit score requirement.

What you should do nigh it: Follow the bones rules of keeping your credit score high — pay your bills, don't let things go into drove, and don't look for new credit unless necessary. Click here to become your credit scores.

What the bank will do: Look at the Credit Inquiry department of your credit study to expect for "not-disclosed liabilities". If items are establish, the bank volition ask for supporting documentation on the research, and will use the data to re-underwrite your mortgage.

What you should do about it: Don't go looking for new credit until after your loan is funded. Catamenia. At present re-read that first judgement, please, to aid it sink information technology.

And remember — this is all happening after your loan has reached "final approval" condition. You should protect your credit all the manner through funding. Don't buy new furniture on credit the 24-hour interval before you lot move in; or buy a car for that new garage.

Loan Approvals Tough, Merely Not Impossible

Fannie Mae began its Loan Quality Initiative to improve its loan pool's overall performance. Ameliorate loan quality helps to keep conforming mortgage rates down and reduces the taxpayer brunt of bad loans. That's 2 big wins.

Unfortunately, the Loan Quality Initiative can also result in boosted mortgage turndowns and cleaved closings.

Therefore, be extra conscientious with your credit between your application date and endmost. If you must buy something big, consider paying cash or waiting it out. major purchases on your credit card tin can exist grounds to revoke an blessing.

Even if your loan is cleared-to-shut.

Apply For A Mortgage With Great, Low Rates

Fannie Mae's Loan Quality Initiative applies to Fannie Mae loans merely. It does not employ to FHA mortgages, USDA loans, VA loans or jumbo loans. However, it's notwithstanding expert smarts to go along your credit make clean while your loan is in-procedure.

To get started with a purchase closing or a refinance, go started with a mortgage charge per unit.

The information independent on The Mortgage Reports website is for informational purposes simply and is not an ad for products offered by Total Beaker. The views and opinions expressed herein are those of the writer and do not reflect the policy or position of Full Beaker, its officers, parent, or affiliates.

Source: https://themortgagereports.com/4163/fannie-mae-loan-quality-initiative

0 Response to "Getting a Va Refi Pull Credit How Many Days to Close Before Pulling Credit Again"

Postar um comentário